Our Volunteer Tax Clinic at Culturelink has been serving clients in person during the tax season for many years. But this year due to concerns surrounding COVID-19 pandemic and isolation the Canada Revenue Agency (CRA) has allowed community organizations to host free Virtual Tax Clinics through the Community Volunteer Income Tax Program (CVITP) while respecting physical distancing guidelines.

LSP program worker Yan Gu has been offering eligible clients virtual appointments for tax preparation services, helping to complete and file their tax returns in April and May through the phone, email or video conference interactions.

Like in-person free tax clinics, virtual tax help is available to anyone with a modest income and a simple tax situation, including newcomers to Canada, social assistance recipients, persons with disabilities and seniors.

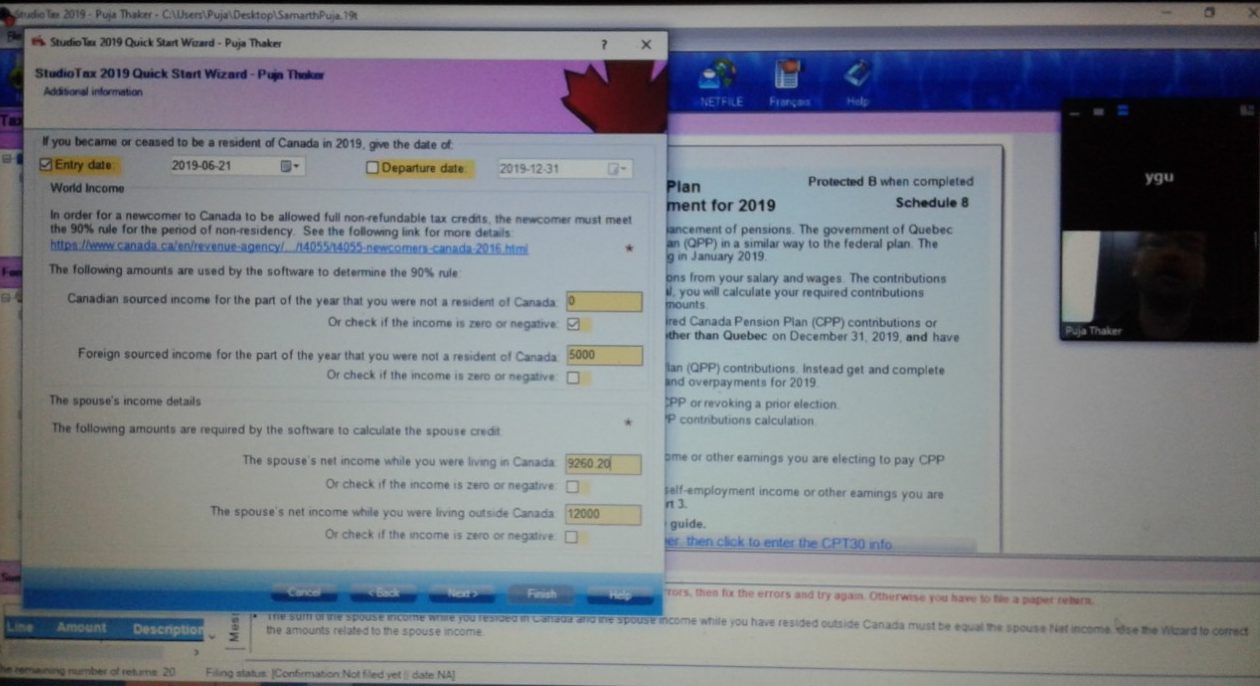

Meeting the needs of some clients who didn’t feel comfortable to provide their personal information online, Yan organized Zoom group training session teaching clients how to use certified tax preparation software, such as Studio tax and Simpletax, to complete their own tax returns online.